The global landscape of grain cultivation is experiencing a dynamic shift as we move deeper into 2025. Climatic fluctuations, advancements in agricultural technology, and evolving trade policies are reshaping how staple crops like wheat, rice, and corn are produced and distributed. As populations grow and dietary patterns change, understanding which nations lead production and how they maintain or improve their yield becomes critical for ensuring food security and economic stability worldwide.

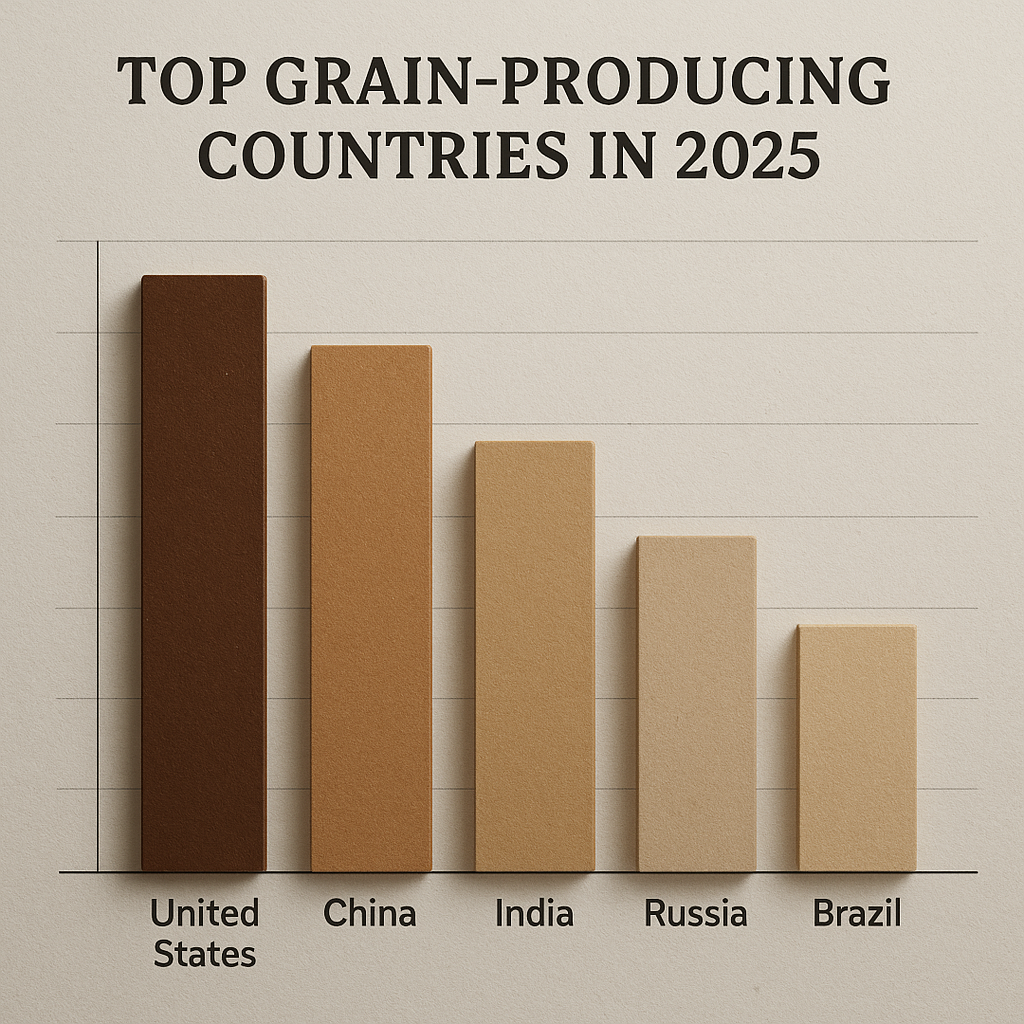

Major Grain Producers in 2025

China

China remains the world’s largest producer of both rice and wheat, leveraging extensive irrigation networks and high-yield seed varieties. Government subsidies and investment in rural infrastructure have bolstered farm-level productivity, driving annual output well beyond 600 million metric tons of combined cereal grains. While domestic consumption remains high, China continues to expand its grain reserves to buffer against supply chain disruptions and unpredictable weather patterns.

India

Following China closely, India has solidified its position as a powerhouse in rice and wheat cultivation. Recent policy reforms focused on minimum support prices for farmers have incentivized higher acreage devoted to cereals. Innovations in mechanization and the adoption of drought-resistant seed strains have increased yield per hectare, pushing annual production figures past 290 million metric tons. Additionally, India’s export capacity for non-basmati rice has surged, enhancing its influence in global grain market dynamics.

United States

The United States retains a dominant role in maize (corn) production, supplying nearly 370 million metric tons in 2025. Cutting-edge precision agriculture techniques—such as drone-assisted crop monitoring and variable-rate fertilization—have driven yield improvements across the Corn Belt. The ethanol industry’s demand for maize remains robust, while U.S. exports of corn and soy are vital to feeding livestock and supporting food processing industries worldwide.

Russia

Russia has emerged as a formidable grain exporter, particularly for wheat. Favorable climatic trends in the southern regions and large-scale investment in farm consolidation have propelled production beyond 110 million metric tons. Strategic expansion of Black Sea port capacities and streamlined logistics corridors to Asia and Europe have allowed Russian wheat to capture growing shares of the global export market.

Brazil

In South America, Brazil continues its impressive rise, with corn and soy rotations dominating its agricultural sector. Annual corn production has climbed above 120 million metric tons, aided by double-cropping systems that maximize seasonal cycles. Precision planting techniques and integrated pest management have further optimized yield. Brazil’s grain corridors to export terminals along the Atlantic coast facilitate seamless access to international markets.

Emerging Trends in Global Grain Markets

- Sustainability and Regenerative Agriculture – Demand for eco-conscious farming methods is growing. Practices such as cover cropping, reduced tillage, and carbon sequestration programs are being increasingly adopted to meet consumer and regulatory expectations.

- Digital Farming Platforms – Cloud-based analytics and mobile apps enable farmers everywhere to access weather forecasts, soil data, and real-time price signals, improving decision-making and reducing waste.

- Trade Policy Shifts – Bilateral agreements and tariff realignments are reshaping traditional export-import flows. Regional trade blocs in Asia and Africa are seeking to lower barriers to secure stable grain supplies.

- Alternative Grains – Quinoa, sorghum, and millet are gaining traction as climate-resilient substitutes in arid regions. These grains diversify diets and provide new export opportunities for developing nations.

- Value-Added Processing – Investments in local milling and packaging infrastructure are rising. Countries are aiming to capture more value domestically instead of exporting raw bulk grain.

Challenges and Innovative Solutions

Despite the progress of top producers, several challenges persist:

- Climate Extremes – Unpredictable heatwaves and floods threaten crop cycles. Farmers are turning to precision irrigation and genetically improved seeds to buffer against drought and disease.

- Supply Chain Disruptions – Pandemic aftershocks and geopolitical tensions have exposed vulnerabilities in transport networks. Enhanced storage facilities and multimodal logistics corridors are being developed to maintain export reliability.

- Rising Input Costs – Fertilizer and fuel price volatility impact profit margins. Cooperative purchasing agreements and research into biofertilizers are emerging as cost-saving measures.

- Labour Shortages – Aging rural populations in many major producing countries are leading to labor deficits. Autonomous machinery and robotic harvesters are becoming more prevalent to fill the gap.

To address these issues, public-private collaborations have formed research consortia focused on climate-smart agriculture. Trial plots using AI-driven crop simulations help scientists and farmers tailor strategies to local conditions. Meanwhile, international organizations are funding programs that strengthen smallholder resilience, ensuring that large-scale achievements do not overshadow grassroots innovation.